Things I wish I knew before applying for a mortgage in Ireland

Getting approval for a mortgage in Ireland is a trickier process than I had anticipated. I naively thought that with a secure job, a down payment at the ready, and an ability to show that I pay my bills on time, I'd have little hassle in getting the mortgage I needed. Well, all I can say is, it wasn't that easy at all. I've typed up some of what I've encountered in the last few months while dealing with banks here, and I hope it's helpful to you. I'm sure a lot of what I've discovered is not only useful to people who have moved here, but also to anybody unfamiliar with applying for a mortgage in Ireland.

Length of residency in Ireland

Your Employment

Another thing that might be an stumbling block for people who just move to Ireland will be their length of service in their current employment. Again, I don't know if this is set in stone, but some banks want you to be in your current job at least 12 months (and it needs to be a permanent position) before they'll consider lending to you. If you take your job with you when you move (e.g. a job transfer to Ireland), this shouldn't be an issue for you.

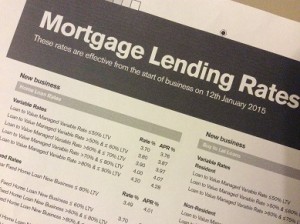

Lending terms and criteria

Due to the fact that most major banks in Ireland are primarily state-owned, and because they are all regulated by the same authority, you might be forgiven for thinking that they might all have the same lending criteria. This is not the case at all. As mentioned above, one bank turned me down because I was new to the country, while the ones that approved me each had different terms they would lend for (30, 35 years etc), and some had wildly different interest rates. One bank now even looks at the amount of rent they could expect to receive on the property, should you default on your loan, while the others don't seem to take this into consideration. To base the amount you can borrow on the rental value of a house seems crazy to me, as rural houses clearly have a low rental value, but might be magnificent homes, worthy of a decent sale price.

Banking history

I can't stress to you enough the importance of having all your records from your previous banks (and country) prior to applying for a mortgage. You will need these to establish your repayment ability, and to prove that the money you currently have was legitimately sourced. The banks that were prepared to work with me wanted a 6 month history of all my United States financial history.

Repayment capacity

The bank will determine your "repayment capacity" based on a number of factors. They want to see that you are paying rent, or saving (or a combination of the 2) the equivalent of what your mortgage would cost. If you can't prove that you can cover the cost of the mortgage, then you can forget about getting a loan! I, in my usual naive way, didn't realize that I needed a savings account for this. I just figured the money that was in my current account (equivalent of a checking account in USA) would suffice. It didn't. I opened a dedicated savings account immediately upon finding this out, but set myself back 2 months by not doing so ahead of time. Lastly on this one, keep your rent receipts (and your rental agreement), and be sure to always be consistent with the dates that you save and pay rent.

Mortgage brokers

In the USA I used the services of a mortgage broker to buy a home there. The norm in the States was that the bank pays the broker a fee for giving them my business. In Ireland (at least in my experience) mortgage brokers charge a fee directly to their clients. I was quoted 200 Euro by 2 different brokers. The upside of this was that that fee would be refundable should I choose to take out a home insurance policy with these brokers. In the end, I decided not to use a broker at all, and I went directly to the banks.

Disposable Income

Each bank will have a "disposable income" requirement. This might vary from bank to bank, but not by much from what I could tell. For a married couple this number was approx 2000 Euro. That's 2000 Euro that you must have left over, per month, after paying your mortgage. If you have children, then for each one, add another 250 to that number. Don't hold me to these numbers. These are what I was given towards the end of 2014, but you might be quoted something slightly different. One important note, is that the disposable income is calculated against the current variable interest rate of the bank + 2%. What that means is that if the banks current variable interest rate is 4.5%, they'll 'stress' that up to 6.5%, calculate your mortgage payment, add your other financial responsibilities (credit union loans, alimony payments etc) and subtract it from your income. What's left over is your disposable income.

Mounds of paperwork

You may find yourself applying to numerous banks. I didn't expect to, but I ended up applying to three. For each bank you'll need to provide 6+ months of bank statements, bills, pay statements, etc, etc. It amounts to a lot of paperwork. If you are not using a broker then each bank will want all of this from you. If you print it all up, I suggest that you request that each bank make their own copies, and give you back yours.

Nameless rubber-stampers

I must say that in all my dealings with mortgage advisers here in Ireland, they were very knowledgeable, very polite and professional, and they answered all my questions. The thing that I found most frustrating about them is that they basically have no say in whether you will be approved or not. I got great vibes each time I went to a bank. Everything seemed in order, and to then be rejected for a loan was a huge surprise. I think this was because I felt that if the local loan manager was saying my application seemed great, then I should have no problems. The applications all seem to go to a head office in Dublin, and some nameless person gives the green or red light. When you have a unique circumstance (such as recently having moved to Ireland), it would be nice to be able to sit down face-to-face with the person who has the final say. I'm not sure when those days ended, but I'm sure they were nice while they lasted.

Other mortgage options

I was never in a position to buy an investment property in Ireland, but it was interesting to find out that they have options available to people who live abroad and want to purchase what they call a "buy-to-let" home. (if you're not familiar with the phrase "to let", it basically means to rent.) Essentially you can buy a home while abroad, and avail of a loan in Ireland. I'm sure this is a great option for Irish emigrants, who want to buy a home here, and one day move back and settle in it. The banks in Ireland offer other kinds of mortgage options too. They cater to home movers, those of you in negative equity, people with tracker mortgages, people looking to extend their current home and more.

Mortgage Calculators

Almost all the bank websites have mortgage calculators in place to help you get an idea of how much you can borrow, and how much your repayments will be. I caution you to only use these as a rough guide. The best way to find out exactly how much you can borrow is to either call in to a branch (appointment might be needed), or phone their mortgage hotline.

That's all I have for now. Feel free to add any relevant information in the comments, or you can also do so by sending me a message.

18 Comments Already

Leave a Reply

You must be logged in to post a comment.

awesome article, very helpful- i am wondering what folks do when wanting to retire or apply ss as a means of income. i must find out more about rent to own. again, thanks for the info!

Hi, my family and i are planning on moving home this year from US. My husband’s parents put a tiny old family home in my husbands name about twenty years ago. We have nothing to do with this property (financially or otherwise). Would you know if this will impact us as first time home buyers in Ireland? Or what resources i could look up to figure this out? Thank you.

Hi Sinead

From what I’ve read at the link below, someone in your situation would still be considered a FTB, however please read it for yourself. It doesn’t specifically mention your circumstance, but from what it does say my take is you’d qualify. Maybe a call to the Revenue service might be a good idea too.

“A First Time Buyer as defined by Section 92B, Stamp Duties Consolidation Act, 1999, is a person, (or, where there is more than one buyer, each of such persons):

who has not on any previous occasion, either individually or jointly, purchased or built on his/her own behalf a house (in Ireland or abroad) and

where the property purchased is occupied by the purchaser, or a person on his behalf, as his/her only or principal place of residence and

where no rent, other than rent under the rent-a-room-scheme, is derived from the property for five years after the date of the current purchase.”

Source:

http://www.revenue.ie/en/tax/stamp-duty/certificates/first-time-buyer.html

PS: I’m assuming the banks use this definition when calculating your loan eligibility. Hopefully a loan manager at the bank you’re with can clarify that.

What if you want to build a home? We have the land already and would like to build. Any tips?

Hi Claudia

I don’t have any personal experience with the self-build process, but I do know that there are some additional steps involved with regards to the mortgage. Things like stage payments, planning costs, construction insurance etc, all play a part in it. Mortgages.ie (a mortgage advisor company who I have no association with) have a good article on the topic to help get you started. Here’s the link to that:

http://www.mortgages.ie/go/moving_house/moving_house_information/self-build-mortgages-for-first-time-buyers

Thanks Liam!

There’s good news for the future for people who will be buying/selling a house in Ireland. The government have a plan in place to overhaul the conveyancing process (that’s the legal work involved in buying or selling property).

They plan to digitize the process and by doing so dramatically reduce the time to do it, as well as potentially reduce the associated costs also.

The Law Society of Ireland, who are responsible for the project, say that the new e-conveyancing system could reduce the total transaction time to as little as five days.

Full details in this article

http://www.independent.ie/irish-news/buying-or-selling-a-house-new-system-will-reduce-legal-time-delays-dramatically-31392839.html

Quote:”Strange! I didn’t let this stop me, and I found at least two banks that had no problem with my recent arrival.”

Could you tell me what Banks that you got a yes from?

Hi Michael

I’m sure many people would like to know which banks they’ll have success with, but due to ever-changing banking laws/guidelines, I’m sure this changes frequently. I’ll send you a private message with my findings if it’ll help, but I would definitely recommend trying more than one bank, or possibly going with a broker.

Cheers,

Liam

Hi Liam,

can you please send me which bank as well on email.

For sure 🙂

Hi Liam

Would you please share the details in private too¬

Many thanks!

Natalia,

at this point the information is approx 2.5 years old. AIB was one of those banks, and I can’t remember off hand what the other was. I hope that helps you get started, but like I say it was a while ago, and the rules do change, so who knows.

liam

Hi Liam. I am 57 and am planning on retiring to Cavan, Monaghan or Donegal. I am third generation Irish descent. Rather than rent (not rejected outright) would getting a mortgage as a retiree be realistic. I could afford to purchase with the full amount but I would prefer to rent. I notice nearly all rents are twelve months.

Hey Terry,

Good question. It certainly wouldn’t be easy, unless they’d be willing to accept your savings or other property as collateral.

The article linked below is a couple of years old, but probably still mostly true. In it they talk about banks reluctance to lend to anyone where the term of the mortgage would stretch into that person’s retirement.

http://www.irishtimes.com/business/personal-finance/are-you-too-old-for-a-mortgage-or-will-you-just-have-to-pay-up-faster-1.2182533

Liam

Many thanks for the two replies Liam. Very impressive.

Hi Liam, did you get my PM from the contact page?